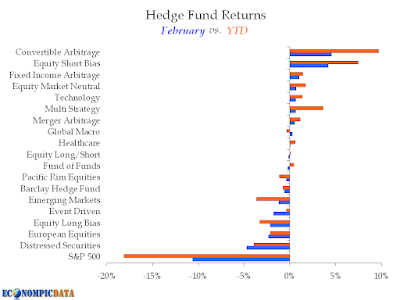

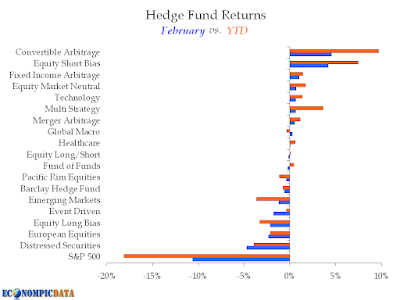

Don't look now, but hedge funds are GREATLY outperforming the equity market.

Source: The Barclay Group

Thursday, March 5, 2009

Hedge Fund "Out" Performance (February)

Labels:

Hedge Funds

Subscribe to:

Post Comments (Atom)

Don't look now, but hedge funds are GREATLY outperforming the equity market.

Source: The Barclay Group

That's because Mutual funds can't short.

ReplyDeleteLet's not forget how well the funds invested in oil were doing in the beginning of last year.

You know I am bearish as hell on the economy long term. However, sentiment is horrible right now. I think we will hit at least a temporary bottom sometime this year. Trading is so thin a 15-25% run would not be surprising. The question is when.

"I think we will hit at least a temporary bottom sometime this year".

ReplyDeleteDom- you need to be more clear than that. Whatever the low is for the year is by definition... the low for the year. Saying it may or may not be temporary removes any forecast completely. You might as well said I have no idea where the market will be... maybe up, maybe down... and that is the problem with the market (the uncertainty).

I will be more clear in my prediction. The market will bounce 20% back within the next month up from whatever low is hit this month. After the 20% is covered, I am shorting the crap out of this pig.

Jake,

ReplyDeleteYou are right. That prediction was vague to the point of being meaningless. Let me clarify the point I was trying to make (since I am not actually a stock picker.)

HF performance will end up being much closer to S&P by year end.

i'll take the other side of that

ReplyDelete