What is Put Writing?

The CBOE has some great resources on what exactly put writing is here, but in a nutshell:

The CBOE S&P 500® PutWrite Index is a benchmark that measures the performance of a hypothetical portfolio that sells S&P 500® Index put options against collateralized cash reserves held in a money market account.What this means is that the index sells puts at a 100% notional value (i.e. there is no leverage). For those more familiar with covered call writing (i.e. writing calls on the stocks you own, which gives up a less certain upside for a more certain option premium), the chart below highlights that covered calls and put writing result in the exact same economic exposure (the green on the left and orange on the right are identical), which is downside risk commensurate to the stock's decline with upside capped at the premium collected (the below chart comparing the two ignores that premium).

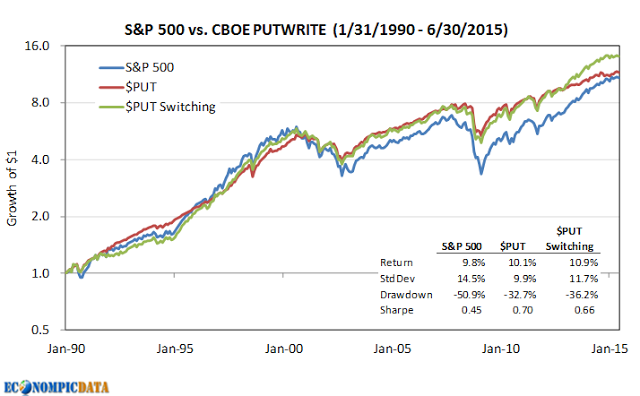

The historical benefit of put writing has been a long run return close to that of the S&P 500 index, with slight underperformance during bull markets and outperformance during bear markets. The PutWrite index can be thought of as an alternative means of capturing the same equity premium; through premium collection in the case of put writing (i.e. collecting the insurance that others are willing to pay to protect their portfolio) vs. the upside of the equity market.

Of note is the PutWrite index has historically achieved this similar performance with a lower risk profile than the S&P 500 (as defined by both standard deviation and drawdown), the reason being that an investor has the same downside risk (the market), but a PutWrite investor collects a higher level of income (the option premium) vs the lower dividend distributions and the option premium increases as market risk increases (while dividends can decrease), helping cushion losses further.

Improving Upon the Strategy Further - Switching Between Put Writing and the S&P 500

The great Philosophical Economics blog wrote a treatise outlining an improved way to manage put writing given that put writing generally underperforms the S&P 500 during bull markets and outperforms during bear market in part due to cushion the higher option premium provides put writing when market volatility picks up (i.e. insuring against a market downturn is more costly when investors view an increased probability of needing that insurance). As a result, an investor may be able to increase returns by allocating to PutWriting at month-end when the VIX is elevated (above 20) and to the S&P 500 at month-end when the VIX is more “normal” (less than 20).

The above rule does improve upon the strategy's absolute return (see "$PUT Switching" in the below chart). YET, that higher return comes at the cost of reduced risk-adjusted returns (higher standard deviation, higher drawdown, and a lower sharpe than the $PUT index itself).

Another Alternative Utilizing a Surprising Characteristic of PutWrite Performance

While I do think the above is an interesting solution, I think it misses one of the surprising characteristics of put writing... its risk-adjusted returns are actually higher when the VIX is lower. As the table outlines below, the absolute returns have indeed been lower when the VIX < 20 (9.2% vs. the 10.6% returns for the S&P 500), the sharpe ratio of the PutWrite index is a whopping 1.20 during these periods (a huge number for a 25 year time frame as any investor can attest). The reason being the level of VIX (or the amount of option premium received) matters less than the premium collected compared to the puts realized payout (i.e. what the insurance is actually paying out). In other words, it is more profitable to insure a good driver at a low insurance premium than a bad driver at a high premium.

As a result, rather than moving from put writing to the S&P 500 when the VIX is below 20 (a move that has resulted in higher returns, but lower risk-adjusted returns), simply increase your notional allocation to put writing when the volatility is low and decrease it when it is high. In the analysis below, my rules are as follows:

If the monthly close of the volatility index (VIX) is above 20, then for the next month invest in the put-write strategy at 67% notional (a 50% reduction) with the balance in 3-month t-bills. If the monthly close of the volatility index is below 20, then for the next month invest in the put-write strategy at 150% notional (a 50% increase) financed at the 3-month t-bill rate.

The end result? Improved absolute return and material improvement in both standard deviation, drawdown, and sharpe ratio.

As an aside... put writing provides a ton of flexibility for an investor. Unlike covered calls, which requires collateral (the stocks you are writing calls against), put writing simply assumes you are holding 100% cash (t-bills). For those that are willing to be creative, there are a lot of interesting things you can do that can provide returns in excess of cash to further improve returns with limited increase in total risk.