Friday, October 31, 2008

EconomPic's of the Week (10/31/08)

Economic Data

Chicago PMI Plunge

Real Per Capita Disposable Income Biggest Drop Since 1949

National Debt Jumps $880B Since September

Non-Durable Goods Consumption Biggest Drop Since 1950

Q3 GDP Down 0.3%

GDP Breakdown... Not "Better" than Expected

GDP Deflator De-Mystified

Durable Good Shipments YTD (September)

Consumer Confidence Analysis (September)

Case Schiller Price Index (August)

Equity / Fixed Income

Global Equity Rebound

Volkwagen Largest Company by Market Cap????

Muni Delever

Another Wild Ride

Commercial Paper Freeze Up

Commercial Paper.... Release the Hounds

Other

With Times Like These... Ya Gotta Drink

Do We Need an Education Bailout?

Fed Cuts 50 bps to 1%... Will it Matter?

VIX Calendar Skew

Yen Based Acquisition Spree on the Way?

Chicago PMI Plunge

Scary doesn’t do this report justice. This abysmal report follows all other pre-ISM regional reports which carried the same tone - an abrupt change occurred in Oct. The plunge in the headline index left it at the lowest level since the 2001 recession. Demand side indicators collapsed. The 21.4 point drop in New Orders was the worst since the series began in 1968; the 40.5 drop in Production was the worst since its inception in 1946! The excess supply signal has never been worse - the New Orders-Inventories spread was -24.0. Price pressures eased rapidly - the 27.0 point drop in the Prices paid index was a record since 1946!

Real Per Capita Disposable Income Biggest Drop Since 1949

Personal income increased $24.5 billion, or 0.2 percent, and disposable personal income (DPI) increased $25.7 billion, or 0.2 percent, in September, according to the Bureau of Economic Analysis.

National Debt Jumps $880B Since September

The National Debt has increased $880 billion since the beginning of September - that isn't a typo - almost $1 trillion in less than two months as the Treasury raises cash for the TARP and for the Fed's liquidity initiatives.

The National Debt is now $10.53 trillion. Remember when the debt passed $10 trillion? That was on September 30th ... less than one month ago.

Source: Treasury Direct

Source: Treasury Direct

GDP Breakdown... Not "Better" than Expected

In Q3, imported goods contributed -1.6% to the GDP Deflator (down from -4.6% in Q2).

As we'll explain, this -1.6% figure is too negative, which means the GDP Deflator is too small. Since the GDP Deflator is the rate required to convert nominal GDP to real GDP, this means the -0.3% GDP figure for Q3 is too high. Lets take a look at petroleum imports (and its impact on GDP in Q3) to see why.

Petroleum imports contributed to roughly 1/4 of the reduction in overall imported goods for the quarter (-0.65% of the -2.43% change - Table 4.2.2). Importing less goods in Q3 contributed a positive 0.45% to GDP, thus the ~1/4 contribution of petroleum imports equates to 0.12% of that growth (Table 1.1.2).

This is based on a -3.3% real change in petroleum imports (Table 4.2.1). HOWEVER, this is the case only if we believe the price of petroleum imports INCREASED 8.4% in the quarter (Table 4.24).

This is based on a -3.3% real change in petroleum imports (Table 4.2.1). HOWEVER, this is the case only if we believe the price of petroleum imports INCREASED 8.4% in the quarter (Table 4.24).

The problem is THE PRICE OF PETROLEUM DECREASED CONSIDERABLY IN ANY MEASURE during the third quarter. Crude prices decreased ~30% in the quarter (end of month June to end of month September) or more accurately for this analysis decreased ~5% using the average price in Q2 vs. the average price of Q3. Below is a chart of the change in the index level for petroleum (as reported by the BEA) vs. the change in the average market price for the past three quarters.

Assuming there was no change in the price of petroleum, rather than a decrease (to be conservative), the reported 3.3% decline in imported units of petroleum becomes a 5% increase. This coincides with the recent reports that miles driven by Americans have rebounded from June lows. This small calculation change turns the 0.12% positive contribution to GDP into a negative 0.18% detraction (or a 0.30% total change to the downside). This would move the GDP figure from -0.30% and "better" than forecast to -0.60% and worse than forecast.This is just one area I specifically targeted, as I was looking for a reversal from some insanely large GDP Deflator contributions from petroleum in Q2. Who knows what else is in there. What I do know is consumption makes up ~70% of GDP and consumption was down a whopping 3.1%. That is certainly not "better" than I was forecasting...

Thursday, October 30, 2008

GDP Deflator De-Mystified

Ed over at Credit Writedowns writes:

The GDP deflator was clocking in at an annual 4.2% clip, whereas last quarter it was a preposterous 1.1% and in Q1 it was a hardly more believable 2.6%. I have been looking for ways to explain this increase in the deflator and can't. If anyone knows, please write me and tell us.

What I imagine they do is:1. Collect the data (quantity and price) to arrive at a nominal number that they seasonally adjust for all of the components of the GDP like imported goods for example.

2. They take this seasonally adjusted nominal figure and match it with a price change figure which is the deflator to get real GDP changes in sub components of GDP. This is how one gets from nominal goods imports to real goods imports.

3. They also then roll up these numbers in a weighted average into a GDP deflator. As imports are subtracted from GDP, that particular item actually DECREASES the GDP deflator.

4. The GDP deflator can then be used to take nominal GDP, which is an aggregation of the nominal sub-components, in order to compute Real GDP.

With Times Like These... Ya Gotta Drink

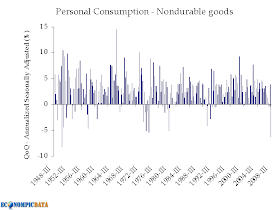

Non-Durable Goods Consumption Biggest Drop Since 1950

The 6.4% rate of decline in spending on non-durable goods, like clothing and food, was the biggest since 1950.

Do We Need an Education Bailout?

According to a September 2008 study by the National Association of Independent Colleges and Universities, of the 504 member institutions surveyed, one-third said the credit crunch had hurt enrollment, and about a fifth of respondents said they had fewer returning students than expected. Roughly the same number said they had a smaller incoming freshman class than expected.

As can be seen above, the credit turmoil has caused AAA rated securitized student loans to spike 400 bps from historic levels. For students seen as a greater credit threat (i.e. parents have a less income / they go to a less prestigious school), rates are significantly higher. This threatens to turn college into a luxury item.

But while head counts slide, needs rise. Demand for student aid is up, but charitable donations from foundations and individuals will fall during a downturn. Ditto for investment returns. And thanks to tanking tax revenue, federal aid may take a hit, too. Taken together, many independent institutions start to look vulnerable.Can we really justify 9%+ student loan rates, while we spend trillions bailing out the financial and manufacturing sectors? Increasing the attractiveness of a higher education (i.e. making it more affordable) when our workforce is expected to shrink over the near term from the slowing economy, may be just what the doctor ordered. In other words, why not subsidize college expenses vs. paying out unemployment?

Wednesday, October 29, 2008

Fed Cuts 50 bps to 1%... Will it Matter?

Consumer Confidence Analysis (September)

The Conference Board Consumer Confidence Index™, which had improved moderately in September, fell to an all-time low in October. The Index now stands at 38.0 (1985=100), down from 61.4 in September. The Present Situation Index decreased to 41.9 from 61.1 last month. The Expectations Index declined to 35.5 from 61.5 in September.Lets take a deeper look. Putting those responding 'bad or worse' in the numerator and 'good or better' in the denominator we get a new measure we'll call the "Armageddon Index" (higher ratio = more negative). Lets see how this "Armageddon Index" scores in various categories:

After an improved outlook in September, consumers now believe the worst is yet to come.

After an improved outlook in September, consumers now believe the worst is yet to come.Source: Conference Board

Tuesday, October 28, 2008

Commercial Paper.... Release the Hounds

Sales of longer-term commercial paper soared 10-fold after the Federal Reserve began buying the corporate IOUs, a sign that the central bank's efforts toward unlocking the market may be working.

Companies yesterday sold 1,511 issues totaling a record $67.1 billion of the debt due in more than 80 days, compared with a daily average of 340 issues valued at $6.7 billion last week, according to Fed data. The central bank probably absorbed about $60 billion of the total, said Adolfo Laurenti, a senior economist at Mesirow Financial Inc.

Source: Federal Reserve

Source: Federal Reserve

Volkwagen Largest Company by Market Cap????

Volkswagen briefly became the world’s largest company by market capitalisation on Tuesday as panic-buying by hedge funds desperate to cover losses caused its value to shoot up by up to €150bn.

Shares in Europe’s largest carmaker soared as high as €1,005 in early trading, having closed at about €210 on Friday. That gave it a market capitalisation of around €296bn ($369bn), higher than that of ExxonMobil, the oil company that closed on Monday with a value of $343bn......

“I have hedge fund managers literally in tears on the phone,” said one London-based auto analyst. Hedge funds had bet that VW’s share price would fall but after Porsche disclosed it held 74 per cent of the carmaker rather than the previously assumed 35 per cent there was a huge scramble to cover positions.

Case Schiller Price Index (August)

- does not own a home

- would like to own a home

- will likely soon buy a home

as it does not include how "affordable" housing has become with the recent price collapse for non-homeowners (full details here).

The Case Shiller Price Index (CSPI) has turned positive year over year for the third month in a row with the spike in August's CPI offsetting further deterioration in the housing market, with the Composite 10 dropping over 17.7% year over year. With future CPI prints coming down as a result of free-falling commodities, expect CSPI to turn very negative in the coming months.

Muni Delever

Hedge funds have been forced to unwind a tremendous portion of their Municipal Bond positions, creating a world in which some Muni's which are backed by Treasuries, present a BEFORE tax yield greater than Treasuries (the chart above shows the entire Lehman Brothers index).

Hedge funds have been forced to unwind a tremendous portion of their Municipal Bond positions, creating a world in which some Muni's which are backed by Treasuries, present a BEFORE tax yield greater than Treasuries (the chart above shows the entire Lehman Brothers index).Source: Lehman

Monday, October 27, 2008

Yen Based Acquisition Spree on the Way?

This makes the performance of Japan's Nikkei 225 equity index distorted (it is down 35% over the past month). If one were to look at the Nikkei 225 against the FTSE in relative terms (i.e. in Pounds), we see that the Nikkei 225 is significantly outperforming the FTSE 100.

This makes the performance of Japan's Nikkei 225 equity index distorted (it is down 35% over the past month). If one were to look at the Nikkei 225 against the FTSE in relative terms (i.e. in Pounds), we see that the Nikkei 225 is significantly outperforming the FTSE 100. If the Yen continues to strengthen, I am curious to see if Japanese companies / investors will take advantage of the relative cheapness of non-Yen denominated companies, which appear to have value in local currencies, but VERY cheap in Yen. Is there a Japanese acquisition spree around the corner?

If the Yen continues to strengthen, I am curious to see if Japanese companies / investors will take advantage of the relative cheapness of non-Yen denominated companies, which appear to have value in local currencies, but VERY cheap in Yen. Is there a Japanese acquisition spree around the corner?

Commercial Paper Freeze Up

Nearly two weeks after the Federal Reserve announced it would step in to support commercial paper, investors are still uncertain whether it will be enough to jump-start the $1.45 trillion dollar debt market.The Federal Reserve's facility, which becomes operational on Monday, Oct. 27, will allow highly rated companies to tap the government for three-month loans that are crucial to their daily operations. This is good news for cash-strapped companies that have been struggling for more than a month to find financing for longer than just one day.

We'll see how rates react to this new facility.

Source: Federal Reserve

Friday, October 24, 2008

Econom-Pics of the Week (10-24-08)

Equity / Fixed Income

Economic Data

LIBOR

Banks / Rating Agencies

Random

Politics

Global Growth Screeches to a Halt

“Volvo said it received 115 order bookings for heavy trucks in Europe in the quarter, down from 41,970 trucks a year earlier.”Click for massive chart in order to see Q3 08 units.

UPDATE:

From comments Sprizouse states...

The rest of the article DOES matter. Volvo cut the numbers when realigning their internal books for global heavy truck orders. Once the books were cleaned it was still shocking to see heavy truck orders, in total, down 55%... but not the ridiculous amount on the chart or the amount Bloomberg's claiming.I'll agree with Sprizouse that there is more to the story. From Volvo's earnings call we learn from Leif Johansson, CEO, all the details of these lousy numbers:

The order intake actually netted --looks like we had a 100% fall and that of course netted and in reality we had 20,000 new orders come in, in the European business. And 20,000 new orders were then offset by around 20,000 cancellations. What happened there was that, the order book then, many of our customers decided to cancel their orders or push forward orders, even sometime in the real near-term, or you can say within the quarter.So, it wasn't 115 total orders, but ~20,000 orders less ~20,000 - 115 cancellations. My new questions... why was Volvo booking the sales in previous quarters if they could be cancelled AND why won't customers cancel these 20,000 new orders as the global economy has gotten significantly worse?

Source: Bloomberg

VIX Spikes.... AGAIN

U.S. regulators are taking a closer look at unprecedented volatility in stock markets near the close of trading, hunting for any signs of manipulation.

"It is something we're looking at," said Brendan Intindola, a spokesman for the Financial Industry Regulatory Authority. "We're really taking an extra close look at it in the light of the volatility we've seen in the market in recent weeks."

FINRA typically looks at "market on close" activity, which are orders executed as near to the end of the exchange day as possible.

But its surveillance unit has now ratcheted up its examination of possible efforts by some firms to try to raise the price of a stock for marking near the end of the trading day. "Marking the close" is a form of market manipulation.

If the market was skyrocketing rather than tanking, would they be investigating this?

If the market was skyrocketing rather than tanking, would they be investigating this?

High Yield Concentration: Banking Issues

Using some new data today from Fitch Ratings, here is the concentrations of high-yield debt by sector in the U.S. The chart compares the current situation with the onset of prior recessionary periods beginning in 2000 and 1989. High-side anomalies.... include autos, banking, and energy, among others.

As Fitch points out, while we have less concentration this time around in specific at-risk sectors, like telecom, we instead have a host of sectors with significant high-yield exposure putting themselves at credit risk in the current downturn.

While there is less concentration among sectors compared to 2000, there is WAY less as compared to 1989. Unfortunately, back then, the largest concentration was in, you guessed it... bank, which fed into other areas of the economy. Expect banking to remain a large component, but concentration to increase outside of the finance sector as problems emerge EVERYWHERE.

While there is less concentration among sectors compared to 2000, there is WAY less as compared to 1989. Unfortunately, back then, the largest concentration was in, you guessed it... bank, which fed into other areas of the economy. Expect banking to remain a large component, but concentration to increase outside of the finance sector as problems emerge EVERYWHERE.

Thursday, October 23, 2008

Basketball Players Shouldn't Be Currency Traders

Childress, 25, is the first player at this stage of his NBA career to spurn the world's most high-profile basketball stage for one of its international alternatives.Why? According to his agent Lon Babby:

"Given the relative strength of the Euro, there are teams with the relative ability to compete with NBA teams for players. It's going to change the dynamic of the process and I'm sure some others will look at it and it could become a part of the business."

Turns out it wasn't such a hot idea...

Update: Looks like the contract was in Dollars, not Euros, thus his contract doesn't become smaller to Josh... it becomes more expensive for the European owner...

Wednesday, October 22, 2008

"It Could be Structured by Cows, and We Would be Rating It"

John A. Yarmuth, a Democrat from Kentucky, chose to read aloud from an instant-message conversation between two S&P employees in the firm’s structured product division.

“The other writes back: “The model does not reflect even half of the risk.’”“The first employee writes back: “Yeah, but we rate every deal. It could be structured by cows, and we would be rating it.’

We Present a Positive Aspect of the Recession

The price of Maine lobster, which accounts for 80 percent of the U.S. catch, is tanking.

The primary factor, a drop-off in demand by penny-pinching diners, has been in place since summer. But a secondary problem recently surfaced: the global banking crisis left Canadian processors short on credit, trapping Maine lobstermen and dealers with too much supply.

Along the Portland waterfront, seafood shops are selling lobsters for as cheap as $3.89 a pound, which is about the price of bologna at the deli counter.

Banks and Brokerages: The Writing was on the Wall

Since then, the cost of borrowing for a AA rated banking and brokerage firm has rocketed another 300+ bps above treasuries and financial equities have dropped more than 50%.

Digging a little deeper, comparing the cost of borrowing for a AA rated bank to those rated A or BBB (all Investment Grade), AA's have escaped most of the harm... relatively speaking. Cost of borrowing for A and BBB rated banking and brokerage firms are now both more than 8% wider than the comparable treasury rate.

Digging a little deeper, comparing the cost of borrowing for a AA rated bank to those rated A or BBB (all Investment Grade), AA's have escaped most of the harm... relatively speaking. Cost of borrowing for A and BBB rated banking and brokerage firms are now both more than 8% wider than the comparable treasury rate.Before I consider a move back into financials (in the equity market), I'll need to see significant improvement here.

Swap Spreads Out of Whack

Swap spreads are MASSIVELY wider on the front end of the yield curve (specifically the two year) than the back (the thirty year). This is odd. As Accrued Interest explains:

To translate... swap spreads is the yield differential between Treasury bonds and the fixed leg of a fixed-floating interest rate swap. Remember that any interest rate swap has to have a bank or other financial institution standing in the middle. With the world scared out of their minds over counter-party risk, how is this spread at all-time tights!?! By comparison, 2-year swaps have a spread of 104bps, and traded as high as 165bps earlier this month.

Things are far from normal. Why specifically? Lets go to Across the Curve:

Things are far from normal. Why specifically? Lets go to Across the Curve:The tightening in the 30 year spread has been driven by pension fund receiving and exotic derivative desk management of positions predicated on the assumption that the 10year/30 year swap rate (not spread ) curve could not flatten to this extent. Desks are short the 30 year sector and position management has them receiving to hedge exposure.

The problem is that one round of receiving begets another which begets another. So the price action in the long end of the swaps curve may produce some relationships which seem unwarranted but are motivated by the urge to survive and trade one more day.

This just reiterates what I said the other day about leverage. The market can't act "normal" when fresh capital is hard to come by. You should still buy bonds based on fundamentals, but bear in mind that it may take a while for fundamental analysis to pay off.

Tuesday, October 21, 2008

Palin a Bigger Issue for McCain than Bush?

NBC:

Now, Palin’s qualifications to be president rank as voters’ top concern about McCain’s candidacy - ahead of continuing President Bush’s policies, enacting economic policies that only benefit the rich and keeping too high of a troop presence in Iraq.Click below for massive chart

By comparison, voters’ top concerns about Obama include, in order:

By comparison, voters’ top concerns about Obama include, in order:• Being too inexperienced.Though fourth on that list, was that Obama was too easily influenced by people like his former pastor Jeremiah Wright and the ‘60s radical Bill Ayers.

• Being too liberal.

• Raising taxes on some Americans.

Click below for another massive chart

Source: NBC/WSJ

Source: NBC/WSJ

More on Employment and it Ain't Pretty....

Less economic activity also means less hiring. The U.S. economy has already lost jobs for nine months in a row. This year’s job losses followed a very weak labor market that left families woefully unprepared for the current crisis. Employment growth has been the weakest since the Great Depression, wages have been flat, and benefits have declined during this business cycle, which started in March 2001. At the same time, prices rose for many items, driving families deeper and deeper into debt.Looking at the October 17th release of median wages by the BLS, we see these words ring true with less employed, those employed earning less (in real terms), and those with lower educational attainment making a heck of a lot less.

Mortgage Equity Withdrawals All but Cease

The second quarter of 2008 saw an anemic $9.5 billion. At that run rate, we could see a drop-off of over 90% from 2005! Now, think what the second quarter would have been without the federal stimulus program of $150 billion. It might have looked and felt like this quarter!Digging a bit deeper into Net Mortgage Equity Withdrawal "MEW", we see just how much U.S. homeowners tapped into their homes (think ATM machines) when values were rocketing. The ability of homeowners to monetize the capital appreciation of their homes offset the stagnant wages we have seen over the past 7-8 years. Unfortunately, MEW has now come to a screeching halt (YTD 2008 in the chart below is through Q2).

In fact, MEW reached upwards of 8% of net income back in 2006, but has now crashed to less than 1%. Is this finally the end of the U.S. consumers ability to be resilient in the face of economic turmoil or just the trigger for another stimulus package?

In fact, MEW reached upwards of 8% of net income back in 2006, but has now crashed to less than 1%. Is this finally the end of the U.S. consumers ability to be resilient in the face of economic turmoil or just the trigger for another stimulus package?