Per Investopedia:

Hedge funds are alternative investments using pooled funds that may use a number of different strategies in order to earn active return, or alpha, for their investors. Hedge funds may be aggressively managed or make use of derivatives and leverage in both domestic and international markets with the goal of generating high returns (either in an absolute sense or over a specified market benchmark). Because hedge funds may have low correlations with a traditional portfolio of stocks and bonds, allocating an exposure to hedge funds can be a good diversifier.Hedge funds shouldn't be thought of as an asset class, rather (in aggregate) they are simply go anywhere investment vehicles that attempt to provide absolute returns with low correlation to traditional asset classes. As an investment vehicle, they just happen to charge an absurdly high fee (a 2% management fee + 20% of excess returns above some threshold is generally accepted as a reasonable starting point).

As an aside, there is a case for managers that can produce consistent, excess returns (i.e. high Sharpe ratios) that are uncorrelated to traditional asset classes to be paid at least 2% / 20%, but there are far and few managers that come close to producing these type of returns legally. For those managers that can, access is limited to the brightest and/or best connected capital allocators. In other words, if you are a retail investor or financial advisor with assets less than $10 billion without a Rolodex that needs its own warehouse... don't bother.

What is an investor to do? I'll show you.

In this case I'll create a "solution" using funds from the world of liquid alternatives. Actually... I'll go one step further and use the two worst performing funds from Morningstar's multialternative category for the ten years ending 3/31/15.

Turning Lemons into Lemonade

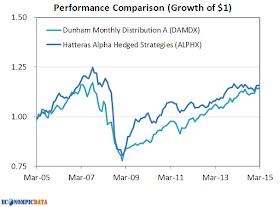

I won't pick on the Dunham Distribution Fund or Hatteras Alpha Hedged Strategies Fund too much... I'll simply show the objectives and present the ten-year equity curve for each fund before outlining how we'll use these funds to create an improved risk-adjusted, uncorrelated, return stream.

Fund Objectives:

- Dunham Monthly Distribution: Seeks to provide positive returns in rising and falling market environments.

- Hatteras Alpha Hedged Strategies: Seeks to achieve consistent returns with low correlation to traditional financial market indices while maintaining a high correlation to the Hedge Fund Research, Inc.(“HFRI”) Fund of Funds Composite Index.

Performance Results (3/31/2005-3/31/2015)

Okay, I need to pick on them a bit more as expenses for both funds were higher than their ten year annualized returns by a significant margin, meaning the investment manager received more money than any buy and hold investor (and this ignores the 5.75% front-end load on the Dunham fund). In addition to producing a negative Sharpe over this time frame with returns that had a very high correlation to equities (go here for details outlining the importance of a high Sharpe ratio and/or low correlation within a broader asset allocation), they have experienced material drawdowns. Despite these returns, the Dunham Fund has grown their asset base to almost $300 million (from less than $100 million in 2010), while the Hatteras fund is slightly above $500 million in assets. If you're one of those investors... would love to know why.

Momentum... Momentum... Momentum... Momentum...

As outlined in my post The Case for Hussman Strategic Growth, a dual momentum approach as introduced in Gary Antonacci's white paper Risk Premia Harvesting Through Dual Momentum (follow Gary at Optimal Momentum), provides the possibility of capturing the absolute performance of an asset (or fund), while avoiding extended periods of underperformance. In this instance, I allocated to either the Dunham Distribution Fund, Hatteras Alpha Hedged Strategies Fund, or short-term bond (ETF IEI) based on whichever was the most above it's 9-month moving average. The resulting time series is then compared with the Barclay Hedge Fund Index, which shows 'the average return of all hedge funds (excepting Funds of Funds) in the Barclay database'.

The result... a dual momentum approach to the two worst performing funds in the multialternative universe has provided all of the absolute return of the average hedge fund, with lower standard deviation, and materially lower drawdown / correlation / beta, all with better liquidity.

What's next? Applying the same framework on a segment of the market that is likely to lead to similar levels of correlation, but with materially higher levels of performance.