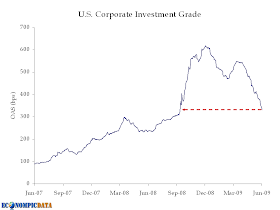

Nine months later, investment grade corporate bonds have recovered from the shock of Lehman Brothers’ implosion. Investment grade spreads, or the premium demanded over Treasurys of a similar maturity, dropped to 371 basis points Tuesday, according to Merrill Lynch. They hadn’t been that inexpensive since September 15, the first day of trading after Lehman Brothers Holdings Inc. filed for bankruptcy.

Spreads had taken quite the ride since spiking at the end of 2008. They soared as high as Spreads soared as high as 656 basis points December 5 before returning 100 basis points. They briefly rallied to 600 basis points in late March and then plummeted in recent weeks. A basis point is 0.01 percentage points.

Source: BarCap

"They hadn’t been that inexpensive since September 15"

ReplyDeleteDoesn't the WSJ mean "expensive"? Lower yield => higher price (or

lower OAS => higher price)