Here's the really fun part: The CBO estimate doesn’t even include any potential stimulus package from Congress and the Obama administration. We haven’t gotten the final details of the plan, but it could cost anywhere from $675 billion to $1 trillion. That means the ultimate 2009 deficit could end up being larger by 60% ... 70% ... 80% ... or more.

And the reported figure is based on what seems to be highly optimistic economic growth. Real GDP is projected to be a little below -2% in 2009, then snap back to 1.8% by 2010. I don't buy these numbers and Paul Krugman details why this projection is overly optimistic based on the estimated GDP Gap and stimulus plan stated (bold is me).

The new CBO budget and economic outlook is out. Above (go to the post) is its forecast for the GDP gap — the hole stimulus has to fill. I’d guess that the CBO estimate, which has unemployment averaging 8.3 percent in 2009 and 9 percent in 2010, is actually too optimistic, but even so it puts the Obama plan in perspective: a 3% of GDP plan, with a significant share going to ineffective tax cuts, to fill an 8% or more gap.

Real GDP is projected at 4% each year from 2011-2014 and 2.5% each year from 2015-2018. This in a world in which the U.S. economy will no longer be levered up. Please note that all of these 2011+ projections are higher than what was projected back in September in growth terms, but they are based on a lower beginning value (and total GDP is down in each year than was projected in September).

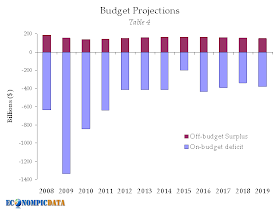

Even with these optimistic numbers, the U.S. projects $400 billion a year in deficits for the next 10 years. We have to pay for this somehow (i.e. borrow), which goes completely against my case in a previous post that Treasuries may not be in a HUGE bubble (though I do think they are over the longer term).

Interesting. I was under the impression that social security surpluses were projected to go extremely negative in the near term as baby boomers draw benefits. Medicare was another expense that was projected to get ridiculously out of hand in the near term if it tracked health care cost growth.

ReplyDeleteAdd that to the huge shortfalls and huge spending plans and it looks really grim- I don't think we can carry that much.

Obama's giving veiled threats to entitlements, but as politically painful as it will be, I don't see any way to avoid insolvency unless there are huge, huge cuts, and soon.