Got to love technology...

First what I didn't miss... with only around 30 minutes of I-Phone browsing per day over the past 2+ weeks, I was able to keep in touch with daily events and even post / comment on them via the social-networking site formally known to me as "stupid / waste of time / I don't get it" and now known as Twitter (I'm saving the phrase "pretty

f'n cool" once I truly understand all its uses).

Not only did it provide a way for me to waste time posting daily economic / financial / interesting articles (i.e. my version of links of the day), but it allowed me to waste time reading about other economic / financial / interesting articles AND world events (i.e. the gripping situation in Iran) in real time. For those interested I will continue to post links to items I don't feel like using a full post on at

www.twitter.com/EconomPic (you will also be able to view the most recent 7 twitter posts (I still don't like the term "tweets") on the upper right portion of the home page.

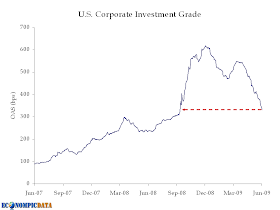

So, what did I sort of, but not fully, miss? Below is a chart of the changes in a few major asset classes (stocks, bonds, commodities) and well as the percent change in the 10 year yield (yes, a percent of a percent).

Sticking out like a sore thumb was the continued sell-off of in longer dated Treasuries. One of the main reasons (along with inflation expectations / less recycled dollars from a decreased current account

deficit) is this week's massive issuance.

Interest Rate Roundup with the details:

The Treasury Department just announced how much debt it's going to sell next week. Get a load of these figures: $61 billion in T-bills. $40 billion of 2-year T-notes. $37 billion of 5-year Notes. And $27 billion of 7-year notes. That's good for a record $165 billion of debt, the most sold in any week ever, driven by increased sales of five-year and seven-year debt. Long bond futures are off about 1 23/32 right now, with 10-year note yields up 11 basis points to 3.8%.

My personal view is that this may actually present a buying opportunity (what you

talkin' about Willis?). In an environment that has continued to deteriorate (i.e. less worse isn't better, though the improvement in continuing claims was striking), you can currently collect a close to 4% REAL coupon (i.e. inflation is currently non-existent and the likelihood of inflation over the medium term is in my mind decreasing, though market expectations certainly disagree).

Why decreasing? Well, along with

limited / no opportunity for workers to demand increased wages, take a look at the chart below using data from the

Federal Reserve detailing the difference between current capacity and average capacity from 1972-2008.

What this shows is that there is massive excess capacity to manufacture goods (durable and non-durable) ready to meet any increase in end-user demand. This means the marginal cost to produce an additional good is minimal. Thus, unless demand increases dramatically in the short-run, inflation should be in check (all else equal).

As an aside, Paul Krugman detailed in a recent lecture (here) that this also poses is a problem to the recovery story. One of the automatic stabilizers in an economy is that at some point new investment is needed (either to replace old capital stock or because new technology is that much better). In this cycle, there is MASSIVE amounts of excess capacity that needs to be filled before any new investment will be put in place (i.e. for the new factory or equipment). While I do believe in the inflation story over the long term (my view is a lot of this excess capacity will fall at some point in the future, not due to increased demand, but due to decrease in supply with companies going out of business), investors in general use very short-term information and have a VERY short memory. If we see continued negative

PPI and CPI prints over the next 3-6 months, I think there is a strong possibility that the inflation story will become the deflation story. In addition, if equity markets lose even a portion of the massive gains (is half the rebound of out the question?) they've seen over the past 3 months, expect investors to once again flock to the "safety" of Treasuries.